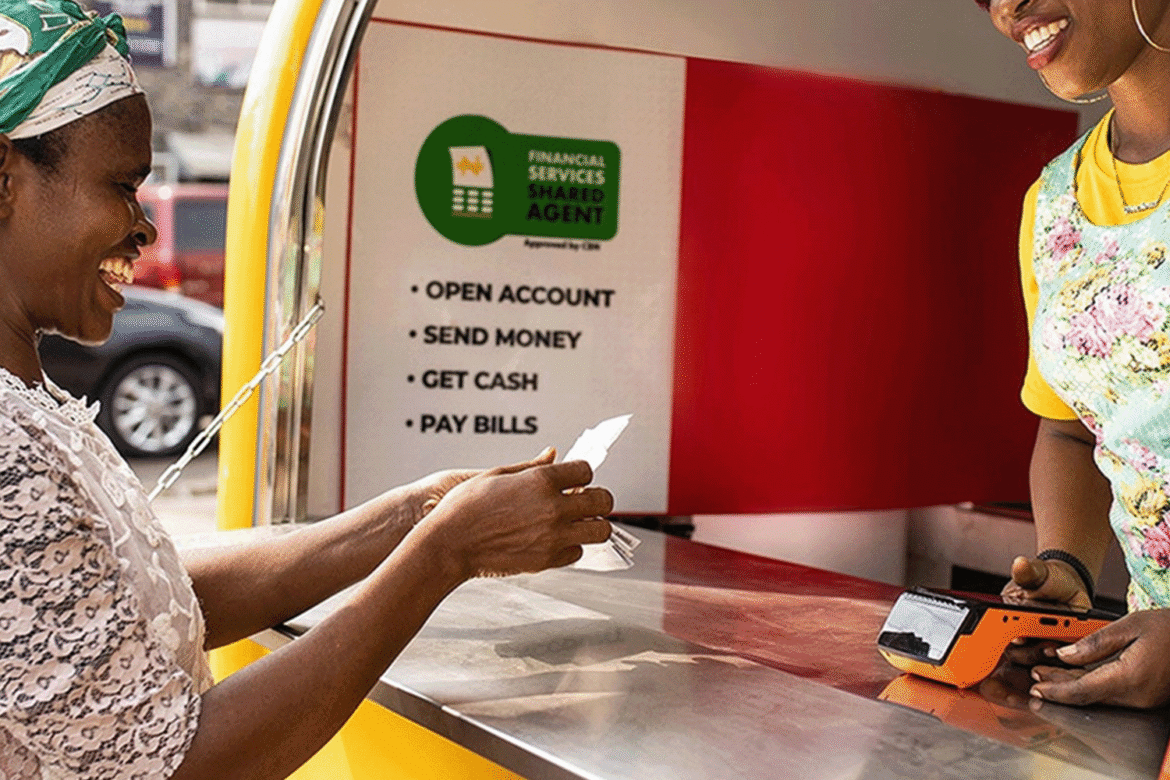

Africa’s digital economy is on the brink of a massive leap forward—and at the heart of it is mobile money. Once a solution to limited banking access, mobile payments have evolved into the backbone of the continent’s growing e-commerce ecosystem. From Kenya’s M-Pesa to Nigeria’s fintech start-ups and South Africa’s digital wallets, mobile money is unlocking new markets, empowering small businesses, and fueling Africa’s next big boom.

Kenya: The M-Pesa Effect

Kenya is the poster child for mobile money success. Since its launch in 2007, M-Pesa has grown from a simple money transfer tool into a comprehensive financial platform used by over 30 million Kenyans.

- E-commerce platforms in Kenya increasingly integrate M-Pesa as the default payment option, making online shopping accessible to millions without bank accounts.

- SMEs and informal traders use Lipa na M-Pesa (“Pay with M-Pesa”) to sell products online and receive instant payments.

- Cross-border expansions into Tanzania and beyond are creating a blueprint for how mobile money can drive regional e-commerce integration.

The result: Kenya’s digital economy is thriving, with mobile money acting as the gateway for consumers to confidently engage in e-commerce.

Nigeria: Fintech Innovation Meets Scale

With its massive population and vibrant start-up culture, Nigeria represents Africa’s largest e-commerce opportunity—but also its most complex. Here, mobile money growth has been powered less by telecoms and more by fintech disruptors.

- Companies like Flutterwave, Paystack, and OPay are enabling seamless online payments for platforms such as Jumia and Konga.

- The Central Bank of Nigeria’s licensing reforms are encouraging more players into the mobile money space, pushing towards a cashless economy.

- Despite infrastructure challenges, Nigeria’s fintechs are pioneering cross-border payment solutions, allowing Nigerian merchants to sell to customers across Africa and even globally.

This innovation is positioning Nigeria as a fintech hub, driving e-commerce growth at continental scale.

South Africa: Digital Wallets and Formal Market Growth

South Africa’s financial landscape is more mature, with higher banking penetration, but mobile money still plays a critical role in expanding e-commerce adoption.

- Apps like SnapScan, Zapper, and MTN Mobile Money are bridging digital payments and online marketplaces.

- E-commerce giants such as Takealot and retailers like Woolworths now integrate multiple mobile wallet options to cater to a broader audience.

- South Africa’s model shows how mobile money can complement traditional banking, making e-commerce faster, safer, and more inclusive.

The country’s high smartphone penetration makes it a testing ground for blending digital wallets, buy-now-pay-later models, and crypto integration—signaling the future of African e-commerce.

The Cross-Border Opportunity

One of the continent’s biggest hurdles has been fragmented payment systems. Mobile money is starting to break down those barriers:

- Regional fintechs are building interoperable platforms that allow a Kenyan buyer to pay a Nigerian seller seamlessly.

- Initiatives like the Pan-African Payment and Settlement System (PAPSS) aim to make intra-African trade smoother under the African Continental Free Trade Area (AfCFTA).

- Start-ups are leveraging blockchain and mobile money integration to reduce transaction fees, making cross-border e-commerce more viable.

Why This Matters

- For Consumers: Mobile money means access to goods and services beyond local markets.

- For Small Businesses: Digital payments lower barriers to entry, allowing informal traders to scale online.

- For Economies: With Africa’s e-commerce market projected to reach $75 billion by 2028, mobile money is the engine driving that growth.

✅ Takeaway: Kenya’s M-Pesa, Nigeria’s fintech disruptors, and South Africa’s digital wallets all tell the same story: mobile money is no longer just about sending cash—it’s the foundation of Africa’s e-commerce revolution. By breaking down barriers and enabling seamless digital trade, it’s powering a boom that could reshape the continent’s economic future.

Last Updated on 6 months ago by %Sunday funday%